Introduction

Swiggy and Zomato are two of the leading online food delivery platforms in India, competing for a share of the rapidly growing market. This case study will compare and contrast their business models, revenue streams, market strategies, strengths and weaknesses, and future prospects.

Company Overview

| Criteria | Zomato | Swiggy |

|---|---|---|

| Founders | Deepinder Goyal, Akriti Chopra, Pankaj Chaddah, Gunjan Patidar | Sriharsha Majety, Nandan Reddy, Rahul Jaimini |

| Revenue | 12,114 crores INR (FY24, US$1.5 billion) | 8,625 crores INR (FY23, US$1.1 billion) |

| Formerly | FoodieBay (2008–2010) | Not applicable |

| Headquarters | Gurgaon, Haryana, India | Bangalore, Karnataka, India |

| Number of Employees | 4,440 (2024) | 6,000 (2023) |

| Subsidiaries | Blinkit, Hyperpure | Dineout Services Pvt Ltd, Scootsy Logistics Pvt. Ltd, MORE |

| Founded |

July 2008

|

1 August 2014 |

Business Models

Swiggy and Zomato operate as aggregators connecting customers with restaurants and delivery partners. Swiggy focuses primarily on food delivery, with a larger delivery fleet ensuring quicker delivery times and wider coverage. Zomato, however, offers a more diverse range of services, including restaurant discovery, table booking, online grocery delivery, and subscription programs. Zomato also provides a comprehensive user experience with features like user-generated reviews, live order tracking, and loyalty programs.

Revenue Streams

Both Swiggy and Zomato generate revenue from various sources:

– Commissions from restaurants

– Delivery fees from customers

– Advertising fees from restaurants and brands

– Subscription fees from customers

– Cloud kitchen rentals from restaurants

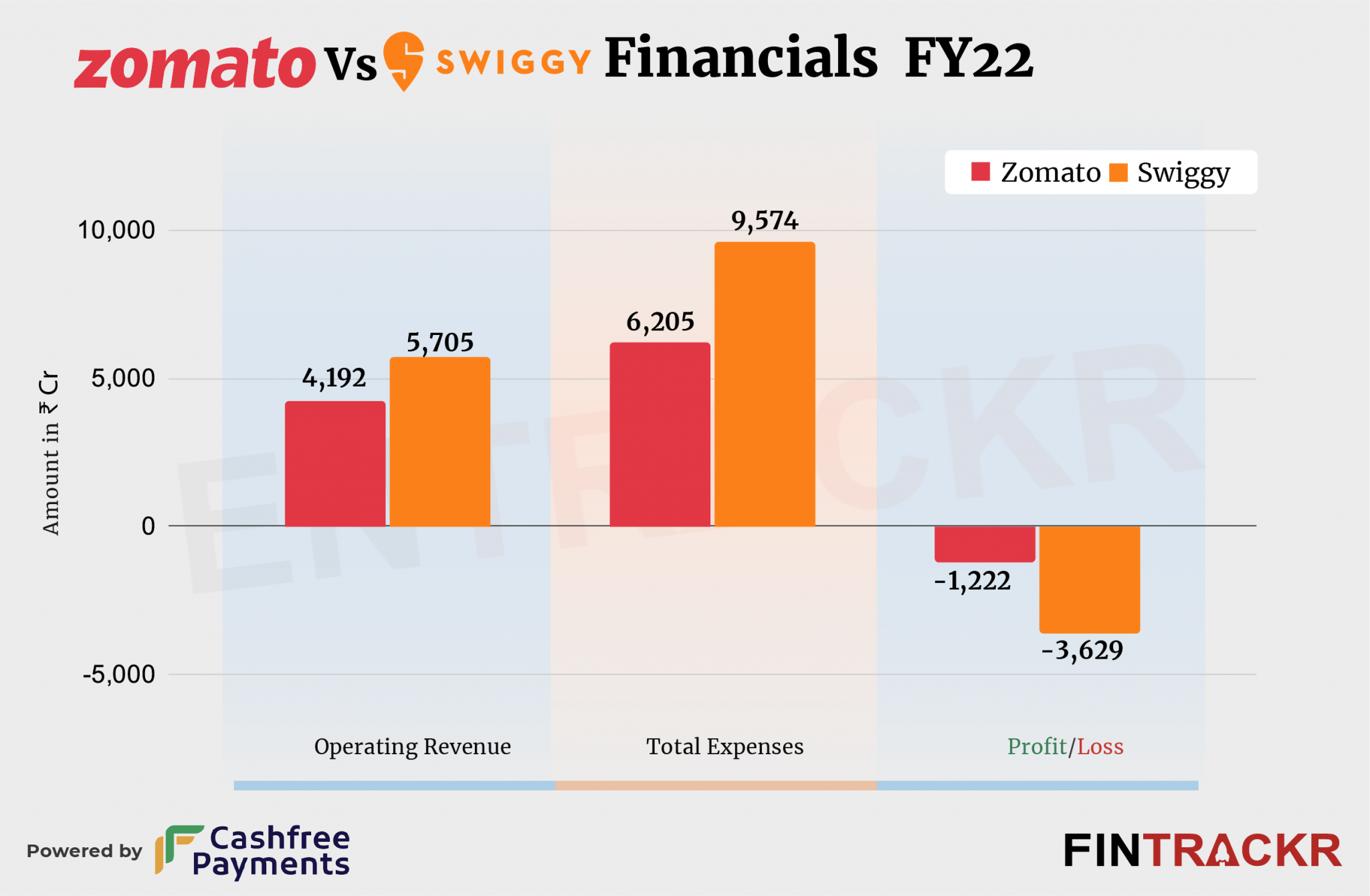

Historically, Zomato has dominated in terms of revenue until the Covid-19 pandemic, when Swiggy briefly surpassed Zomato. As of June 2021, Zomato reported a revenue of ₹5,705 crore (US$710 million) for FY22, while Swiggy reported ₹4,860 crore (US$610 million) for FY21.

Market Strategies

Swiggy and Zomato have distinct market strategies:

– Swiggy has expanded its presence in tier-2 and tier-3 cities and introduced new services like Instamart (grocery delivery) and Swiggy Genie (package delivery).

– Zomato has focused on acquiring other market players, such as Uber Eats, and has also launched its IPO.

Both companies heavily invest in technology, including artificial intelligence, machine learning, data analytics, and cloud kitchens.

Strengths and Weaknesses

Swiggy:

– Strengths: Fast and reliable delivery, strong delivery network, diversified services, customer-centric approach.

– Weaknesses: High operational costs, dependence on external funding, lack of profitability, regulatory challenges.

Zomato:

– Strengths: Large customer base, wide range of services, strong brand recognition, successful IPO.

– Weaknesses: Low customer retention, high competition, negative cash flow, legal issues.

Future Prospects

The Indian online food delivery market is expected to grow at a CAGR of 28% from 2020 to 2025, reaching $12 billion by 2025. Both Swiggy and Zomato are well-positioned to capitalize on this growth by expanding their customer base, increasing order volumes, improving unit economics, enhancing customer satisfaction, and strengthening their competitive advantage.

Comparative Analysis

| Criteria | Zomato | Swiggy |

|---|---|---|

| Home Screen |

|

|

| Cost of Items and Delivery Charges |

|

|

| Payment Methods |

|

|

| Revenue Model |

|

|

| Unique Selling Proposition (USP) | Extensive menu range with detailed restaurant information, including ratings and reviews | Timely delivery with no minimum order requirement |

| Initial Public Offering (IPO) | Went public in July 2021 | Preparing to go public, aiming to raise $800 million |

| User Experience and User Interface |

|

|

Revenue Model

Swiggy’s revenue primarily comes from advertising, commission, and delivery fees. Zomato’s revenue is driven by food delivery, dining out, and Hyperpure (sustainability). For FY21, Swiggy recorded revenue of ₹25 billion, while Zomato’s revenue was ₹20 billion. Despite a revenue loss, Swiggy has a higher daily order volume compared to Zomato.

Unique Selling Proposition (USP)

Swiggy: Timely delivery with no minimum order requirement.

Zomato: Extensive menu range with detailed restaurant information, including ratings and reviews.

Initial Public Offering (IPO)

Swiggy is preparing to go public, aiming to raise $800 million to compete with Zomato. Zomato went public in July 2021, becoming India’s first food delivery startup to do so.

User Experience and User Interface

Zomato: Offers extensive features such as booking seats and checking locations. The app focuses solely on food delivery.

Swiggy: Expanded its platform to include grocery and medicine delivery. The app has a broader service range.

Conclusion

In the competitive landscape of online food delivery in India, Zomato and Swiggy stand out as the top players. Zomato’s comprehensive service range and strong market presence give it a slight edge over Swiggy, which excels in delivery speed and efficiency. Both companies continue to innovate and expand, positioning themselves for future growth in a thriving market.

Frequently Asked Questions (FAQs)

1. What are the main differences between Zomato and Swiggy?

Zomato:

- Founders: Deepinder Goyal, Akriti Chopra, Pankaj Chaddah, Gunjan Patidar

- Revenue: ₹12,114 crores INR (FY24, US$1.5 billion)

- Formerly: FoodieBay (2008–2010)

- Headquarters: Gurgaon, Haryana, India

- Number of Employees: 4,440 (2024)

- Subsidiaries: Blinkit, Hyperpure

Swiggy:

- Owners: SoftBank Group, Prosus, Accel

- Founders: Sriharsha Majety, Nandan Reddy, Rahul Jaimini

- Founded: 1 August 2014

- Headquarters: Bangalore, Karnataka, India

- Number of Employees: 6,000 (2023)

- Subsidiaries: Dineout Services Pvt Ltd, Scootsy Logistics Pvt. Ltd, MORE

2. What is the revenue of Zomato?

Zomato reported a revenue of ₹12,114 crores INR for the fiscal year 2024, which is approximately US$1.5 billion.

3. When was Swiggy founded?

Swiggy was founded on 1 August 2014.

4. Where are Zomato and Swiggy headquartered?

- Zomato: Gurgaon, Haryana, India

- Swiggy: Bangalore, Karnataka, India

5. How many employees does Zomato and Swiggy have?

- Zomato: 4,440 employees (2024)

- Swiggy: 6,000 employees (2023)

6. What are the subsidiaries of Zomato and Swiggy?

- Zomato: Blinkit, Hyperpure

- Swiggy: Dineout Services Pvt Ltd, Scootsy Logistics Pvt. Ltd, MORE

7. Has Zomato undergone any rebranding?

Yes, Zomato was formerly known as FoodieBay from 2008 to 2010 before rebranding to its current name.

8. What are the key differences in the business models of Zomato and Swiggy?

Zomato offers a comprehensive range of services including restaurant discovery, table booking, online grocery delivery, and subscription programs. Swiggy, on the other hand, focuses primarily on food delivery but has expanded to include services like grocery delivery through Instamart and package delivery through Swiggy Genie.

9. Which company has a larger delivery fleet?

Swiggy has a larger delivery fleet compared to Zomato, which contributes to its ability to offer quicker delivery times and wider coverage.

10. What are the primary revenue sources for Zomato and Swiggy?

- Zomato: Food delivery, dining out, and Hyperpure (formerly sustainability).

- Swiggy: Advertising, commissions, and delivery fees.

Comments are closed.